We can help you reduce insurance costs and add depth to your employee benefits with our FSA account solution.

A Flexible Spending Account (FSA) is a pre-tax plan that is beneficial to both employees and the employer. It helps employees increase their take home pay and helps employers lower their FICA contributions they receive as a tax benefit by reducing payroll taxes. Part of our service commitment is continued support and education to the employer and employees. This will help increase participation creating a benefit that could pay for itself.

MEDICAL FSA & LIMITED PURPOSE FSA

Set aside money to pay eligible 125 expenses not covered by your medical insurance. There are two types of Medical FSA accounts:

- Medical FSA

Use a medical flexible spending account to pay for medical, dental and vision expenses not covered by your health insurance plan.

- Limited Purpose Medical FSA

A limited purpose flexible spending account is available when you are enrolled in a high deductible health plan (HDHP) and a health savings account (HSA). The Limited purpose FSA can only be used to pay for dental and vision expenses.

DEPENDENT CARE ACCOUNT (DCA)

A dependent care flexible spending account allows you to set aside money pre-tax to pay for day care for children up to age 13, before school and after school programs, day camp during the summer and a disabled dependent of any age. To qualify for this type of spending account, both parents must work full time or be full-time students.

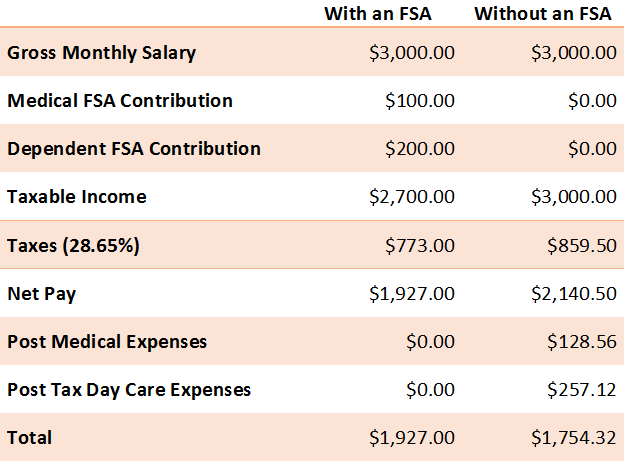

HOW MUCH CAN I SAVE USING MY FSA PLAN?

THE BENEFITS OF CHOOSING ADMIN AMERICA AS YOUR ADMINISTRATOR:

- Customer Support: Customer service representatives are available via phone or e-mail Monday – Friday 8:30 am – 5:30 pm EST.

- Technology: Admin America offers a mobile application and online portal that allow you to check your balance, file a claim, and view your account activity 24/7. Your online portal also has an “expense tracker” where you can store your receipts in one convenient place.

- One Debit Card for all FSA/HRA/HSA Plans: Admin America uses the same Debit Card for all of our FSA/HRA/HSA products. Participants who use more than one of the pre-tax accounts will have the ability to load all of their elections onto one Debit Card.

What are the differences between Healthcare FSAs, Limited Purpose FSAs, and Dependent Care FSAs?

- A Healthcare FSA allows reimbursement of qualifying out-of-pocket medical expenses. Common eligible expenses include dental treatment, orthodontia, prescription drugs, diagnostic services, hospital services and surgery, laboratory fees, obstetrical expenses, chiropractic care, physical therapy, eye examinations, glasses, contact lenses, laser eye surgery, hearing aids, smoking cessation programs, and weight loss programs to treat obesity, to name a few.

- A Limited Purpose Medical FSA works with a qualified high deductible health plan (HDHP) and Health Savings Account (HSA). A limited FSA only allows reimbursement for preventive care, vision and dental expenses.

- A Dependent Care FSA allows reimbursement of dependent care expenses, such as daycare, incurred by eligible dependents.

Can I participate in both an HSA and an FSA or HRA at the same time?

A Medical FSA plan can only be used at the same time as an HSA plan if the FSA is designed as a Limited Purpose Medical FSA only paying for dental and vision expenses. An HRA can only be used at the same time as an HSA if the HRA is a post deductible HRA plan and the participant meets a certain threshold in deductible expenses out of the HSA prior to receiving reimbursements from their HRA.

Can I change my annual FSA election after the plan year starts?

Certain qualifying events do allow for increases/decreases to a participant’s annual election in the medical and dependent care FSA plans. Common qualifying events are such things as marriage, divorce, birth of a child, adoption and decrease in costs of childcare services.

If you have any questions about a qualifying event please contact our FSA team.

May I use the Medical FSA to reimburse qualified expenses incurred by my spouse and dependents even if they are enrolled in a different health plan?

Yes, the FSA plan is designed to pay for qualified expenses incurred by you, your spouse and dependents even if they are enrolled in another health insurance plan outside of your organization.

Where can I find out what expenses will qualify for reimbursement?

One of Admin America’s valued partners is the FSA Store where you may search a list of over-the-counter (OTC) eligible expenses. A complete list of eligible expenses is available on the IRS web site: IRS Publication 502. Remember too that our knowledgeable FSA Team is available to answer specific questions M-F, 8:30 am – 5:00 pm EST by calling 678-578-4641 directly.

Please be aware that OTC (over the counter) medications may require a prescription from your doctor in order to be considered eligible.

How do I give access for my spouse and dependents to obtain information about my account?

If you would like for your spouse and/or dependents to receive information about your account please fill out a release form giving us the names of the individuals you authorize us to speak to about your Medical FSA account.

To download a copy of Admin America’s Individual Authorization to Release Protected Health Information to allow your spouse to have access to your benefits account CLICK HERE.

What type of documentation is required to substantiate a claim?

In order for an expense to be substantiated in our system we need third-party (i.e., the provider) documentation that includes the following three pieces of information:

- Date of service (i.e., the date services are incurred not the date the expense is paid)

- Description of the services received

- Amount paid for the service

Make sure and let your provider know you are paying with FSA funds to ensure they give you a detailed receipt that includes the above information. CREDIT CARD RECEIPTS ARE NOT SUFFICIENT DOCUMENTATION TO SUBSTANTIATE AN EXPENSE ACCORDING TO IRS REGULATIONS.

When do I need to substantiate an expense paid with my benefits Debit Card?

During plan implementation we request a copy of the benefit summaries from your employer to load all of the set dollar amounts from your plans into our system. These set dollar amounts will include transactions of co-pays and prescriptions. Our system will recognize these transactions when you incur them on your debit card and not require you to submit supporting documentation.

If you incur expenses that do not match the set dollar amounts from your plans you will be requested to submit supporting documentation to Admin America for us to substantiate the claims in our system. You are being requested to submit these documents in order for us to prove to the IRS the expenses you incurred are eligible expenses to be paid out of your FSA plan.

You may click on the links below to access any of the documents. You may need Adobe Reader installed on your computer to open the documents below.

NEW PLAN IMPLEMENTATION:

Consumer-Driven Healthcare Plan(s) New Case Implementation Kit

EMPLOYEE INFORMATION:

Convenient Mobile and Online Access Guide

Filing a Claim vs Substantiating a Claim

FSA Reimbursement Documentation Form

Dependent Care Blank Receipt Form

EE Direct Deposit Authorization Form

PHI disclosure authorization form

Debit Card – Transaction Dispute Form

FSA Store OTC Eligible Items List

EMPLOYER INFORMATION: